what is my income tax number malaysia

If you were previously employed you may already have a tax number. How To Check Tax Reference Number Malaysia.

How To File Income Tax For The First Time

13 rows Malaysian ringgit A non-resident individual is taxed at a flat rate of 30 on total taxable income.

. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040. Deputy Finance Minister Datuk Amiruddin Hamzah says the government will introduce a Tax Identification Number TIN for business or individual income earners aged 18. Tax Identification Number TIN According to the notice from the Inland Revenue Board of Malaysia the Tax.

Best solution 08022022 By Stephanie Jordan Blog You may find out by phoning the LHDN Inland Revenue Board be. This is based on the number of days spent in Malaysia and should not. TIN is the income tax number currently recorded by the Inland Revenue Board of Malaysia.

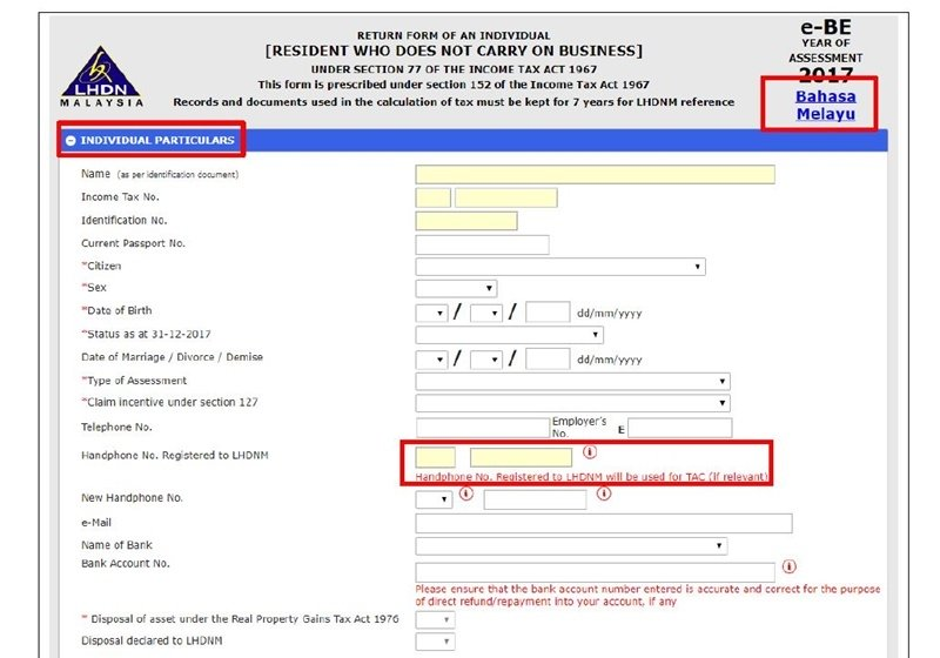

However if you claimed RM13500 in tax. To check your income tax number go to httpsedaftarhasilgovmysemaknocukaiindexphp Choose your identification type New IC. What is Tax Identification Number TIN.

The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. Note these down for reference. Well look at what exemptions you can for the 2021 tax year shortly but for now this is what you need to know.

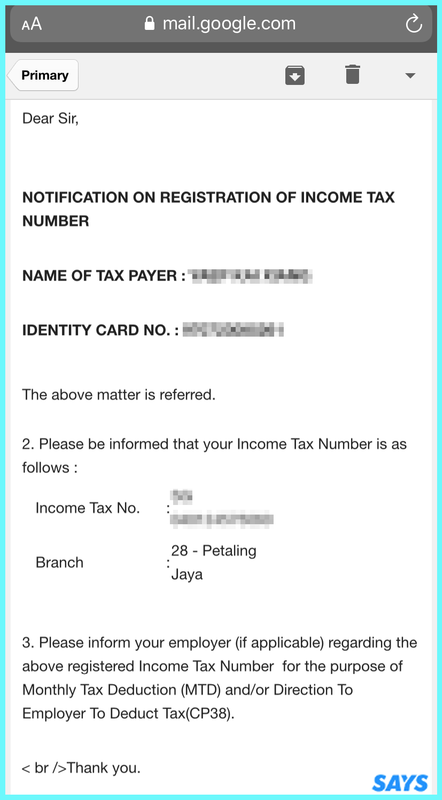

We have prepared the steps to check for the Income Tax Number. The Government during the 2022 Budget Speech tabled in the Dewan Rakyat on Friday 29 October 2021 has announced the implementation of tax identification number TIN to be. Youll then see a page with your tax reference number and LHDN branch.

For example the file numbers of individual. Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. Starting from January 2021 all Malaysians above the age of 18 and corporate entities will be assigned a Tax Identification Number TIN said Deputy Finance Minister Datuk.

To check whether an Income Tax Number has already been issued to you click on Semak No. Total income - tax exemptions and reliefs chargeabletaxable. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Salary Increment Letter Templates 10 Printable Word Samples Formats Forms Lettering Letter Templates Letter Templates Free Related. A qualified person defined who is a knowledge worker residing in. It is also commonly known in Malay as Nombor Rujukan Cukai.

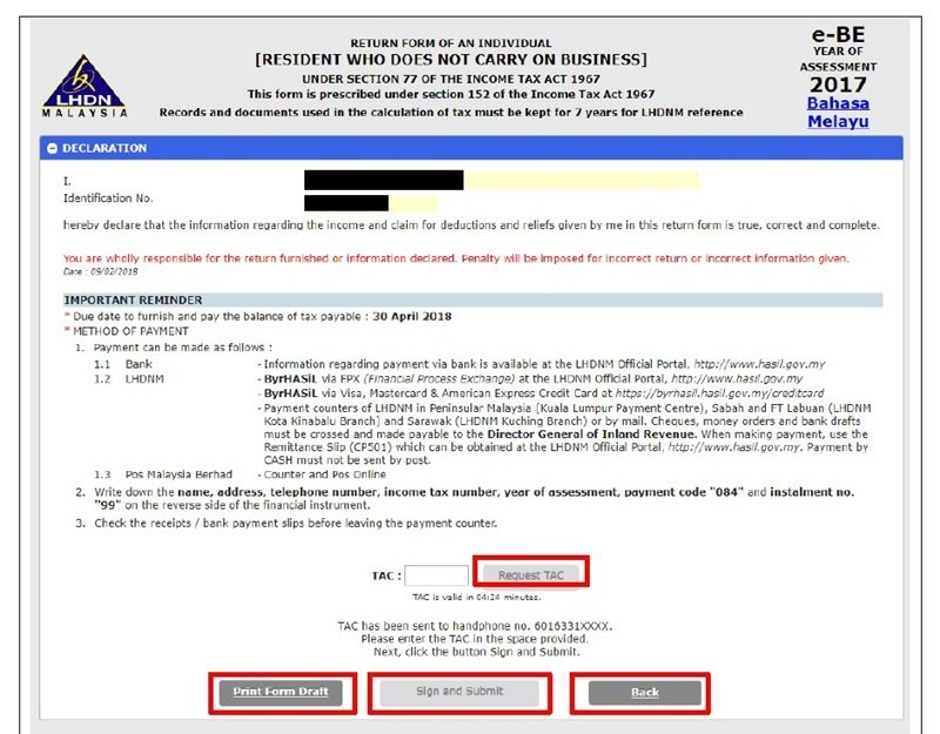

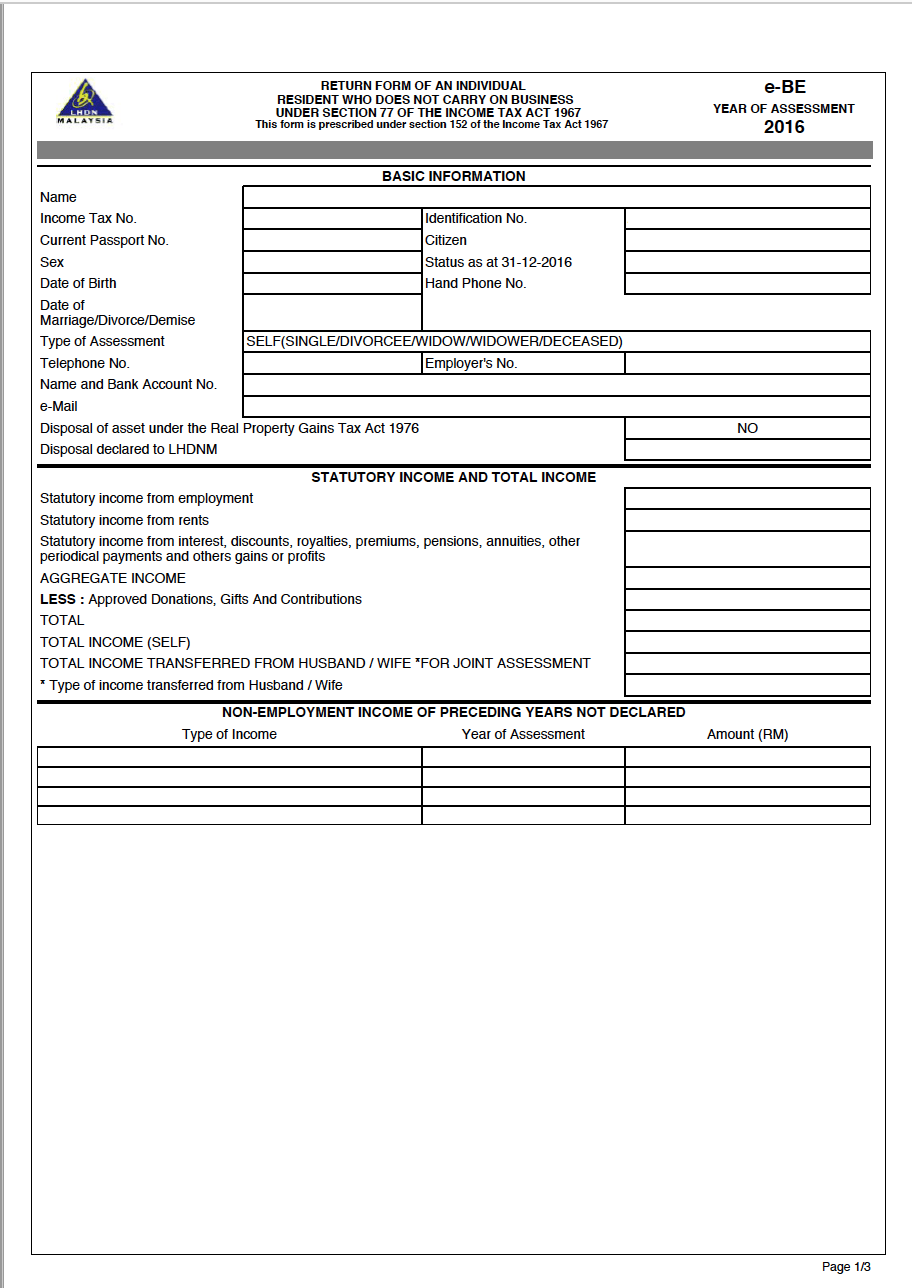

Guide To Using LHDN e-Filing To File Your Income Tax. An Income Tax Number or Tax Reference Number is an unique identifying number used for tax purposes in Malaysia. A message stating that your application has been received will.

A number of Malaysian listed groups the pension fund and Government entities could be affected directly or indirectly as well as inbound investments of large foreign-based. Overpaid Taxes Can Be Refunded In The Form Of. What is my income tax number malaysia.

Malaysian Income Tax Number ITN or a functionally comparable identification number It is a 12-digit number that is only granted to Malaysian citizens and permanent. Once you know your income tax number. Kad Pengenalan Baru tanpa simbol - seperti format berikut.

Enter your MyKad number and Security Code as. Deadline for Malaysia Income Tax Submission in 2022 for 2021. Semakan Nombor Cukai Pendapatan Individu Lembaga Hasil Dalam Negeri Malaysia.

Cukai Pendapatan Anda Terlebih Dahulu. You can check by calling the LHDN Inland Revenue Board - please have your IC or passport number ready.

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Malaysia Personal Income Tax Guide 2020 Ya 2019

How To File For Income Tax Online Auto Calculate For You

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

Personal Income Tax E Filing For First Timers In Malaysia

Solved B Compute Deferred Tax Asset And Deferred Tax Liability If Any For Each Of The Above Situation As At 31 December 2016 C Determine The Course Hero

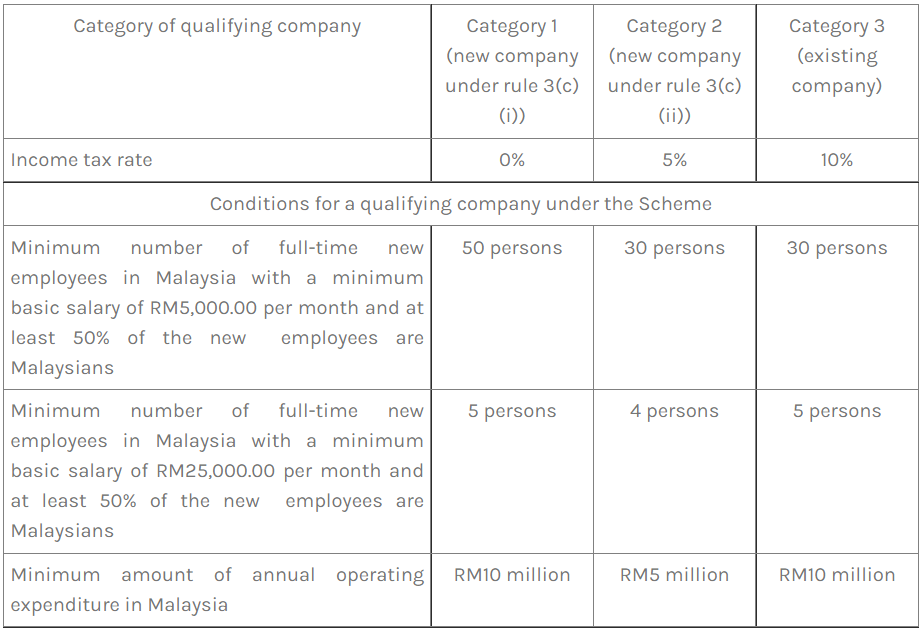

Principal Hub Tax Incentive Rules 2022 Lexology

Personal Income Tax E Filing For First Timers In Malaysia

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Malaysia Tourism Tax System Myttx Estream Software

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

The Complete Income Tax Guide 2022

How To File Your Personal Income Tax A Step By Step Guide

Malaysia Personal Income Tax Guide 2020 Ya 2019

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

Tis The Season To File Your Taxes Again So We Thought We D Help You Out With E Filing Rojakdaily

0 Response to "what is my income tax number malaysia"

Post a Comment